Welcome back to Celeritas Capital today we have a special post. The guys at

were kind enough to agree to write an article for Celeritas CapitalThe Money Machine Newsletter is a Substack we recommend 100%. At Celeritas Capital we are always sure to read their newest post. Let me tell you a little bit about what they are all about.

It’s designed to help you become a smarter, independent investor with two things:

Market-beating stocks in a 5-min read. Picked by elite traders. Delivered weekly to your inbox pre-market.

Market, investing, and business insights from insiders and experts outside the mainstream media.

You won’t find the same watered down stock picks like other services. Nor will you find the same regurgitated mainstream media information here. You’ll find actionable insights in the

. If you like what you read today make sure you subscribe below.I’ll let Money Machine Newsletter take it from here…

This week’s market, investing, and business insights from insiders and experts outside the mainstream media:

Google’s cash machine got a rewrite and most missed it.

Our gene tech could become China's gold rush.

Downbeat energy stock with high upside potential.

$35 popcorn and the business is BOOMING.

And more. Let’s get to it!

Top Insights of the Week

1. 😳 We Called It: Google’s BIG Shift

Google’s been printing money off search ads for two decades. That’s changing...

At their I/O event, they introduced something called AI Mode. No more long list of links. No more ads shoved in your face. Just straight answers.

It’s smoother for users. But rougher for the ad business.

They also rolled out a $250/month bundle. YouTube Premium. Cloud storage. AI tools. Even a video generator. No ads. Just subscriptions.

Why? Because they see what’s coming… we called it out a few weeks back, while the mainstream media was asleep at the wheel… here’s the gist…

AI answers don’t play nice with ads. You can’t stick a banner in the middle of a clean response. It breaks the flow. So Google’s shifting. Away from clicks. Toward subscribers.

They’re not chasing ChatGPT. They’re outgrowing themselves. Breaking the old model before it breaks them. The search box will stick around. But the business behind it? That’s getting rewritten.

This was the week Google stopped tweaking the past—and started betting on the future.

2. 🔬 Our Science Is China’s Payday

There’s a baby alive today because someone changed one letter in his DNA…

He was born with a rare mutation. One typo in his genetic code. That tiny error stopped his liver from clearing out toxic waste. Ammonia built up in his blood. No fix meant brain damage. Or worse.

But a group of researchers didn’t wait around. They used CRISPR—gene editing tech—to fix the single broken letter. Not in a lab. Not in theory. In his body.

They wrapped the edit in liquid nanoparticles. Injected it into his blood. It found its way to his liver. Made the change. No side effects.

This kind of “one-letter typo” causes up to +10,000 genetic diseases. We’ve barely scratched the surface…

Imagine a future where we fix disease with code, not pills. Change the sentence. Not just manage the symptoms.

But this tech is expensive. Many families can’t even afford the gene tests, let alone the treatment. Meanwhile… China’s catching up fast—building biotech firms using U.S. research. Copy. Paste. Profit… If we’re not careful, we’ll invent the cure... and they will own it.

3. ⚡️ Downbeat Energy Stock With High Upside Potential

First Solar’s not your typical panel pusher. It’s one of the last U.S.-based solar manufacturers standing. No China reliance. No copycat parts…

What stands out for them? Their thin-film tech… sleeker, lighter, lower carbon footprint. Built different — and patented like crazy (1,600+ of 'em).

Solar global market expected to reach $436B by 2032. And First Solar’s in the thick of it…

Revenue jumped ~25% last year. Profits? ~Up 55%.

Dropped $500M on a new R&D lab.

Cracked 23.1% efficiency on their CdTe cells — a new record.

Risks?

On going tariff uncertainty. Q1 earnings missed by ~23%. Guidance got cut.

The Inflation Reduction Act used to be a tailwind. Now it’s at risk — some want it repealed or trimmed down.

Global politics, cheaper rivals, and tech shifts. But the potential? Massive… This is a high-upside bet on American energy, backed by brains, patents, and policy (as of now).

Top 3 Charts of the Week

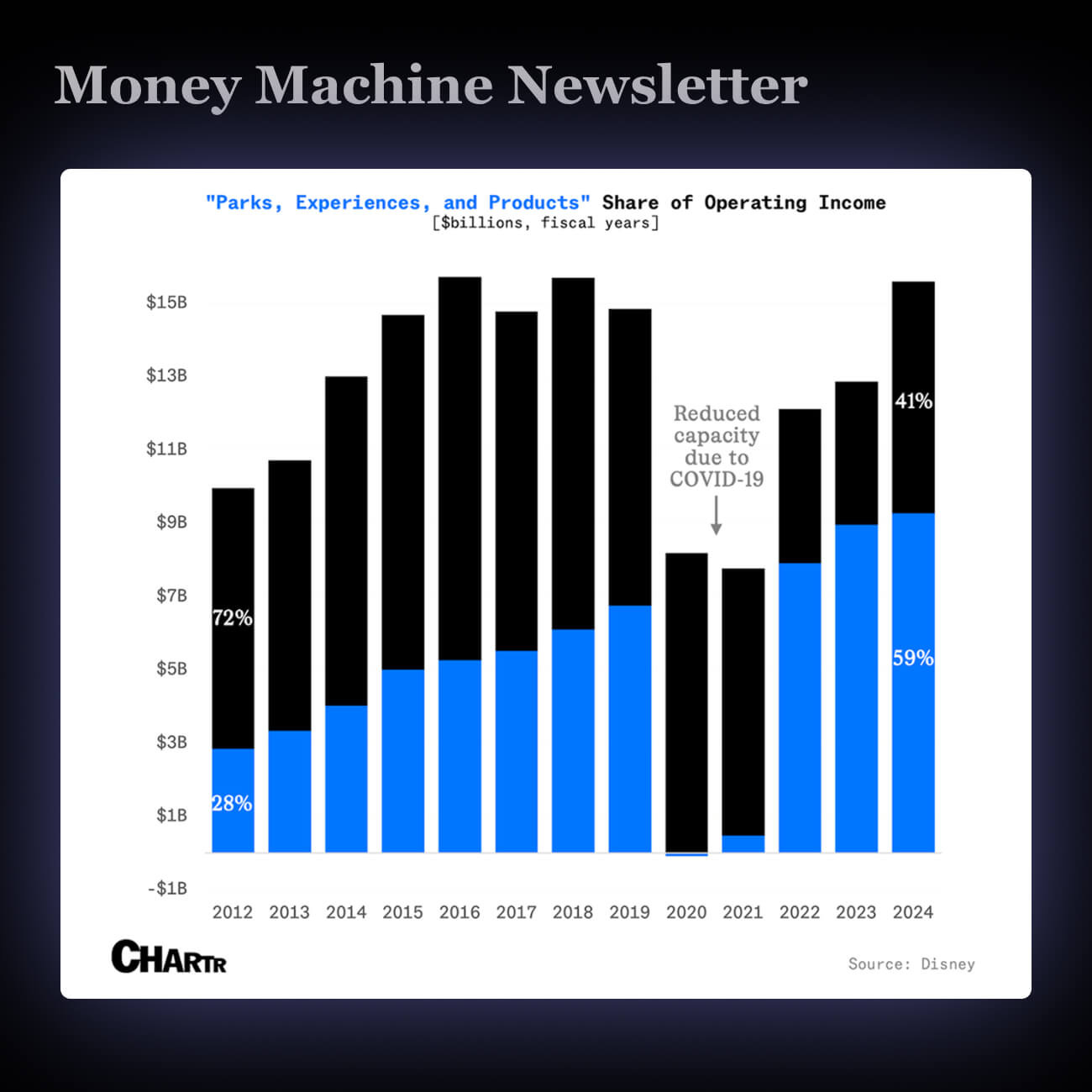

1. 🎢 Theme Parks Are Disney’s Cash Cow

Comcast just opened Epic Universe, its biggest theme park ever—costing ~$7B—with rides based on Nintendo and other big franchises.

They’re taking a swing at Disney’s turf. But Disney still dominates, with 8 of the 10 most visited parks and ~$9B in theme park profits last year.

While streaming is shaky, theme parks print money. Both giants are betting people will keep paying $35 for popcorn and hundreds for a thrill.

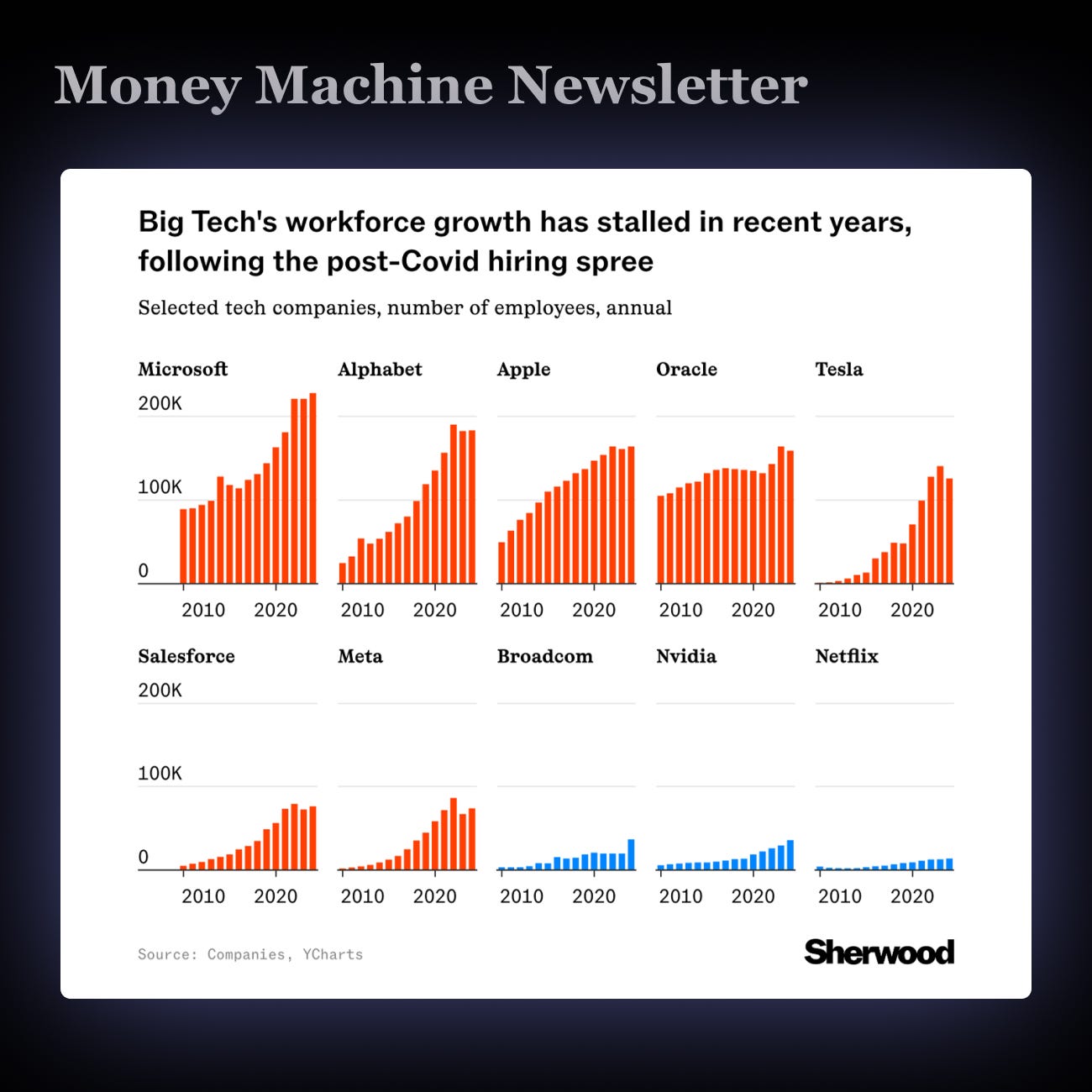

2. ❌ The Big Tech Job Freeze Era

Big Tech keeps cutting jobs. Over 22,000 U.S. tech workers were laid off in 2025. Companies like Microsoft, Google, and Meta are shrinking. Even solid roles aren’t safe.

AI is changing who stays and who goes. If you’re building AI or chips, you’re in demand. If not, your job may be on the chopping block—or never open up at all.

The job market’s shifting. Fast. It’s not just about layoffs—it’s about where the future jobs aren’t.

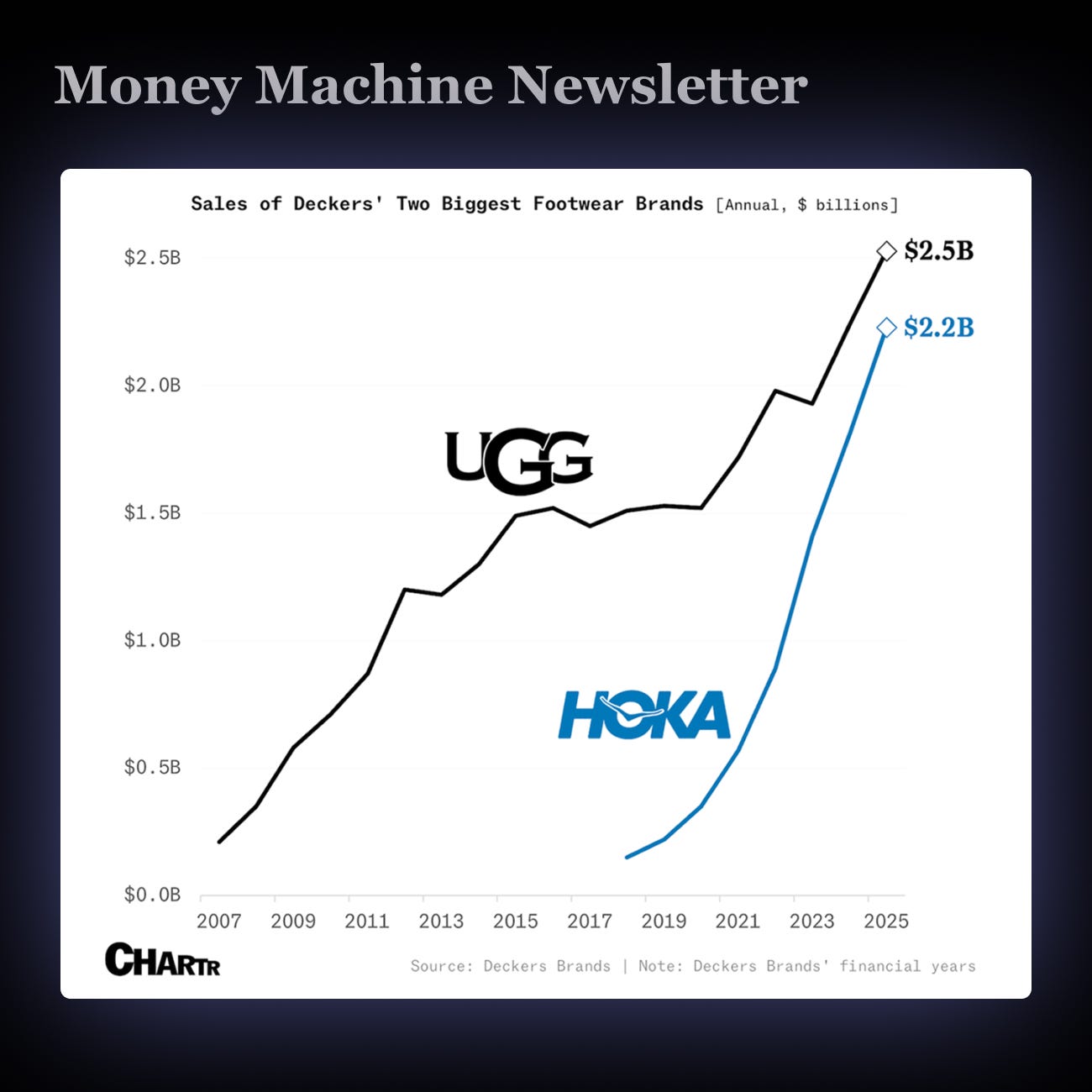

3. 👟 Hoka Closes in on Ugg

Hoka, the fast-growing running shoe brand under Deckers, saw sales jump to $2.23B—but growth is slowing. It went from 58% to 28% to 23% in the past three years.

Deckers gave no forecast for next year, blaming global trade issues. That spooked investors. The stock dropped 22% in a single day and is down over 50% this year.

Join 6,000+ self-directed investors who have already placed themselves on the path to greater wealth by making $500, $1,000, $2,000, $3,000, or more every month with Money Machine Newsletter’s trade ideas.

Goog is for glorified android cameras.

Boring.